Get Your CGM Covered By Insurance

Continuous glucose monitor (CGM) systems help people with Type 1 and Type 2 diabetes easily measure their blood glucose levels continuously throughout the day.

Newer CGM systems, such as the Freestyle Libre systems and the Dexcom systems, can help manage diabetes by allowing users to adjust insulin dosing without the need for fingersticks.*

But how much do these CGMs cost, and how much of that cost will your insurance cover?

Learn about the cost of CGMs and determine if you can receive low-cost diabetes care supplies and CGM devices covered by insurance.

What Will My Insurance Cover for a CGM?

It’s estimated that CGM devices and related products can cost up to $6,000 a year out-of-pocket!

That’s a high price for necessary healthcare, especially when you may be eligible to have your CGM covered by Medicare or other private insurance plans.

The products you can receive through Aeroflow Diabetes depend on what your specific insurance plan allows.

Currently, Aeroflow Diabetes offers two types of CGM systems that your insurance may cover:

Dexcom Continuous Glucose Monitoring Systems and Abbott Continuous Glucose Monitoring Systems.

CGM systems typically consist of two basic components:

1. Reader: When you initially start CGM therapy, you get a reader.

2. Sensors and Transmitters (Ongoing Supplies): Your sensors will be provided monthly or quarterly regardless of your system. The Dexcom G6 also has a transmitter, which is provided quarterly.

Typically, your CGM reader and supplies will be covered under your insurance. This means what you owe will depend on your deductible and out-of-pocket limits. This means sometimes your insurance doesn’t pay anything towards your CGM reader and supplies (you pay the entire cost), and sometimes the insurance pays the entire amount (you pay no cost).

This plays out by paying the full cost of your CGM supplies until your deductible is met. Once your deductible is met, you will be responsible for some portion of the cost (co-insurance) until your out-of-pocket limit is met. Let's walk through a few examples using fictional Medicare patients to explain further.

Example Patient #1

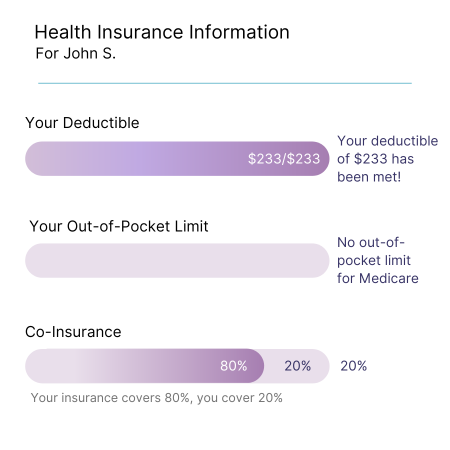

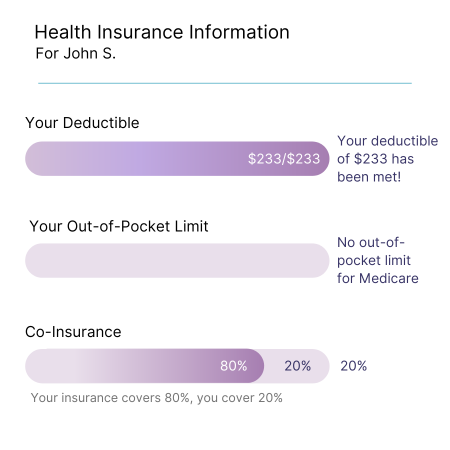

John has never used CGM before. However, he has filled out the Aeroflow Diabetes Eligibility Form and has been told he’s eligible to receive a CGM covered by insurance.

John has a traditional Medicare plan with no secondary insurance, and his deductible has already been met. To get started, John will receive one CGM reader and one month’s supply of CGM sensors to start.

John’s specific Medicare plan will pay $384.20 (80% of the total cost) since he’s reached his deductible of $233, and he has no out-of-pocket limit. John will pay the remaining $96.05 (20% of the total cost) for his initial supplies.

*This is an example, and rates and costs will be subject to change based on your insurance coverage and plan rates. Your deductible, co-insurance, and patient responsibility are also solely determined by your insurance plan.

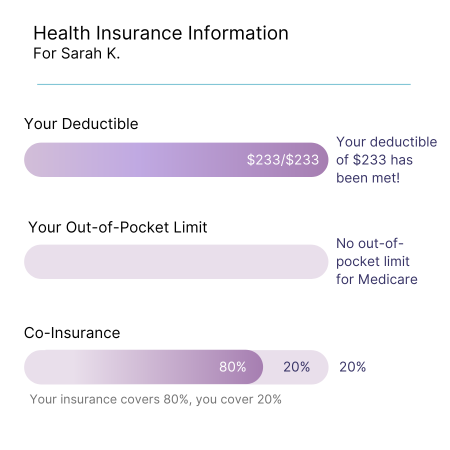

Medicare Deductible: $233

Medicare Out-of-Pocket Limit: Medicare doesn’t have an out-of-pocket limit.

Co-insurance: 20%

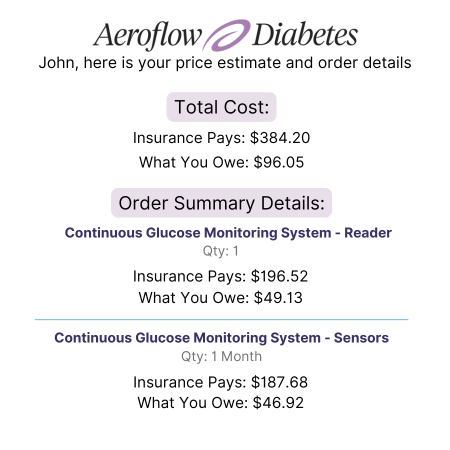

Order Summary:

- Continuous Glucose Monitoring System - Reader- Qty: 1

- Insurance Pays: $196.52

- What You Owe: $49.13

- Continuous Glucose Monitoring Sensors - Qty: 1 Month

- Insurance Pays: $187.68

- What You Owe: $46.92

Total Cost:

- Insurance Pays: $384.20

- What you Owe: $96.05

*Medicare requires that you receive a CGM reader regardless if you choose to use your cell phone or other smart device., This is a one-time requirement subject to standard Medicare DME equipment's reasonable useful life (RUL).

Example Patient #2

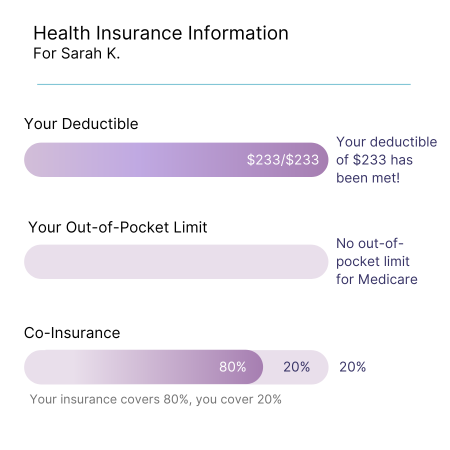

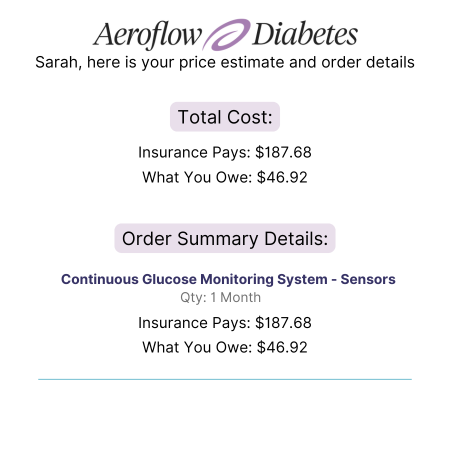

Sarah also has a traditional Medicare plan but already uses a CGM system. She receives a monthly supply of continuous glucose monitor sensors through Aeroflow Diabetes. Medicare allows suppliers to distribute 3 months’ worth of sensors at a time. However, Medicare billing requirements dictate that suppliers bill every month.

So, even though Sarah is getting a 3-month supply, the payment will be separated into 3 months. Each month, Sarah’s insurance will pay $187.68 (80% of the total cost) since she’s met her deductible. She’ll be paying the remainder of $46.92 (20% of the total cost) each month, she’ll have 30 days' worth of supplies in hand.

This is an example of how Medicare will cover the costs of a 3-month supply of CGM sensors, but your coverage and prices will be subject to change based on your insurance plan.

*This is an example, and rates and costs will be subject to change based on your insurance coverage and plan rates. Your deductible, co-insurance, and patient responsibility are also solely determined by your insurance plan.

Medicare Deductible: $233

Medicare Out-of-Pocket Limit: Medicare doesn’t have an out-of-pocket limit.

Co-insurance: 20%

Order Summary:

- Continuous Glucose Monitoring Sensors- Qty: 1 Month

- Insurance Pays: $187.68

- What You Owe: $46.92

How You Can Qualify for Low-Cost CGM Devices With Insurance

If you have Medicare or other private insurance plans, you may be eligible to receive CGM supplies at little-to-no cost.

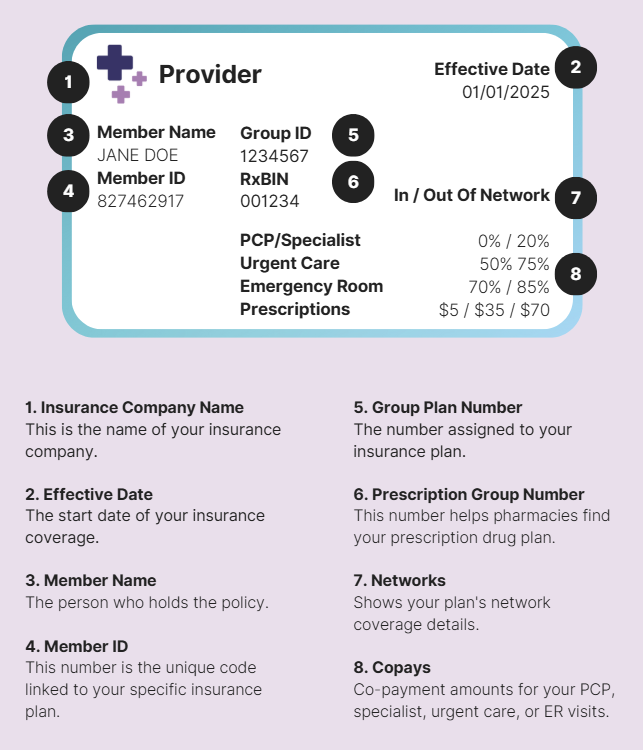

Follow these steps to see if you qualify, check your coverage by filling out the Aeroflow Diabetes Eligibility Form. It’s fast and easy; just have your insurance card on hand.

Once approved, our specialists will contact you to help you complete all the necessary paperwork. We’ll also answer any questions you may have about CGM insurance coverage or our CGM systems.

After choosing your supplies, they’ll be shipped directly to your home.

CGM Insurance Coverage FAQs

How do I know if I have traditional Medicare or an Advantage plan?

What happens to my costs if I have secondary insurance or supplemental coverage?

How do I know what CGM supplies are covered through my insurance policy?

Will my Medicare coverage for CGMs change based on the state I live in?

Insurance Glossary

- What Your Insurance Pays: Based on your deductible, out-of-pocket limit, and co-insurance, this is the estimated amount of money your health insurance provider will pay toward your CGM supplies. This amount can be $0 if your deductible is unmet.

- What you Owe: Based on your deductible, out-of-pocket limit, and co-insurance, this is the estimated amount your health insurance provider requires you to pay out of your pocket. This amount can be more than $0 if your deductible is unmet, or your deductible is met and you are paying the co-insurance portion of the cost.

- Your Deductible: A deductible is an amount you must pay out of your pocket before your health insurance provider will begin covering a predetermined percentage of your medical costs.

- Out-of-Pocket Limit: Out-of-pocket limit is the maximum amount of money you will have to pay out of your pocket in a 1-year time frame. Once you’ve met your out-of-pocket limit, most health insurance providers cover any new medical costs at 100%.

- Co-insurance: Co-insurance is the percentage or amount you must pay out of your pocket once your deductible has been met. Like a copay, co-insurance is the cost-share you are responsible for paying for covered services.

For a glossary of common diabetes care terms, visit our glossary of terms page.

Simplify Diabetes Management With Low-Cost CGMs Covered by Insurance

Managing diabetes doesn’t have to be expensive or complicated. With CGMs covered by insurance, like the Dexcom and Freestyle Libre, you can keep track of your glucose levels effortlessly in real-time.

Find out if your insurance covers a CGM and start enjoying the benefits of continuous glucose monitoring. Complete our secure Eligibility Form to check your coverage and learn about low-cost options.

Information provided on the Aeroflow Diabetes website is not intended as a substitute for medical advice or care from a healthcare professional. Aeroflow recommends consulting your healthcare provider if you are experiencing medical issues relating to diabetes care.

* Fingersticks are required if your glucose alarms and readings do not match symptoms or when you see Check Blood Glucose symbol during the first 12 hours.