Key Takeaways:

- CGMs provide real-time glucose data, improving diabetes management and reducing emergency interventions.

- Medicare and many insurers now cover CGMs, easing financial costs for those who need frequent insulin adjustments.

- Consult your healthcare provider to choose the best CGM for your needs.

Continuous glucose monitoring (CGM) has proved a welcome development in diabetes technology. Medicare and most major private health insurance plans now offer some level of coverage and reimbursement for CGMs when prescribed by an endocrinologist or healthcare provider.

Does Medicare Cover Diabetic Supplies?

Medicare, along with Medicaid and several other major private health insurance plans, offers different levels of coverage and reimbursement options for CGMs, including Blue Cross Blue Shield, CIGNA, and United Healthcare, among over 500 others. CGMs are generally considered durable medical equipment (DME) and can be ordered through approved DME companies like Aeroflow Diabetes and paid for, at least partially, by Medicare or private insurance.

What Other Health Insurance Plans Cover Diabetic Supplies?

Along with Medicare coverage and most state Medicaid coverages, CGMs are covered benefits for most commercial insurance providers. All insurances have basic clinical coverage criteria that you must meet in order to qualify, and the products you may be eligible for depend on what your specific primary or secondary insurance company allows.

How Has Medicare’s CGM Coverage Changed?

Medicare has provided coverage for CGM systems since 2017, provided they are classified as “therapeutic” devices, meaning you can use them to make treatment decisions. These include things like changes to exercise regimen, diet, or insulin dosage. While that’s still the case, The Centers for Medicare & Medicaid Services (CMS) have recently relaxed Medicare’s other coverage criteria somewhat.

Previously, Medicare coverage of CGM devices was limited to patients who met the following requirements:

- Have a diagnosis of either type 1 or type 2 diabetes.

- Use a traditional blood glucose meter and test blood sugar levels four or more times a day.

- Are treated with insulin injections or insulin pumps.

- Require frequent adjustments to their insulin regimen.

- Have an in-person visit with a doctor to evaluate glycemic control and whether they meet the above criteria, as well as follow-up appointments every 6 months after prescription.

So what’s changed?

- The requirement for multiple daily injections has been reduced to one dose per day

- Coverage for those not injecting insulin may be available to patients experiencing hypoglycemic events

- Diabetics who are treated with inhaled insulin will be eligible for coverage.

- Additionally, the requirement for self-testing up to four or more times a day with a fingerstick test has been removed, so diabetics who test less frequently may also be eligible.

It’s a promising development that will make therapeutic CGM devices accessible to more diabetics. Many of them may not have been eligible for Medicare coverage previously, having to pay out of pocket instead. This change took effect in July 2023, and could save some people thousands of dollars per year.

Which CGM Devices Are Covered by Medicare?

The Dexcom G5 was one of the first of the CGM devices to be FDA-approved as a therapeutic CGM in 2017, which qualified the device for Medicare coverage. As with most other technology, diabetes technology continues to evolve, and newer products have since followed suit, including those manufactured by Abbott, Medtronic, and others.

Currently, Aeroflow Diabetes offers the following CGMs through Medicare and private insurance plans if you qualify:

The FreeStyle Libre Systems and the Dexcom G7s are worn on the upper arm, while the Dexcom G6 is typically worn on the skin of the torso for up to 10 days. A water-resistant sensor can measure and transmit blood glucose readings every few minutes to a reader or a smartphone app.

The FreeStyle Libre Systems are a line of CGMs that are typically worn on the skin of the upper arm for up to 14 days. While each of the FreeStyle Libre Systems continually measures blood glucose levels, the LIbre 2 transmits data only when scanned and the Libre 3 is a complete push system - meaning it transmits data to its receiver continuously. Each has its own set of unique features, alarms, and recommended age ranges.

If you live with type 1 or type 2 diabetes, use traditional blood glucose monitoring supplies and require frequent changes to your insulin dosage, you may be eligible for insurance coverage. The first step is to speak with your healthcare provider. Only your healthcare provider will be able to determine which CGM is best for your diabetes care plan. Aeroflow Diabetes will help coordinate with your insurance company and your healthcare provider to make sure you receive maximum benefits.

What Is the Average Cost of a CGM Device?

The out-of-pocket costs of CGM devices can be significant, much more than traditional blood glucose monitoring systems. Depending on what model and features you need, you will have to get prescriptions for several different items and purchase them at a retail pharmacy if you don’t have insurance coverage. These can include multiple sensors, a transmitter, and a receiver.

While readers are required for CGM use, some models work in conjunction with a smartphone, for added convenience. With the Dexcom G7 system, the average retail cost for sensors for one full year is $3600, or $300 per month, wihtout insurance, which is a cost barrier for many. Costs are lower, and vary, through insurance.

This new coverage change announced by Medicare, as well as the continued expansion of private insurance coverage, is good news for diabetics who could benefit from the convenience and improved outcomes possible through the use of CGM devices.

Will My Insurance Cover My CGM System?

CGM systems, like Dexcom and FreeStyle Libre Systems, offer a seamless way to monitor your blood sugar levels and make real-time adjustments to your diabetes management plan. With more accessible insurance coverage now available, many diabetics can avoid the high out-of-pocket costs associated with traditional glucose monitoring.

Medicare, along with many major private health insurance plans, offers coverage and reimbursement options for CGMs at different levels. These include Blue Cross Blue Shield, CIGNA, and United Healthcare, among others. More health plans are being added to the list as successful clinical trials continue and the FDA approves new real-time continuous glucose monitors. They are typically considered durable medical equipment (DME) and can be ordered through approved DME companies like Aeroflow and paid for, at least partially, by Medicare or private insurance.

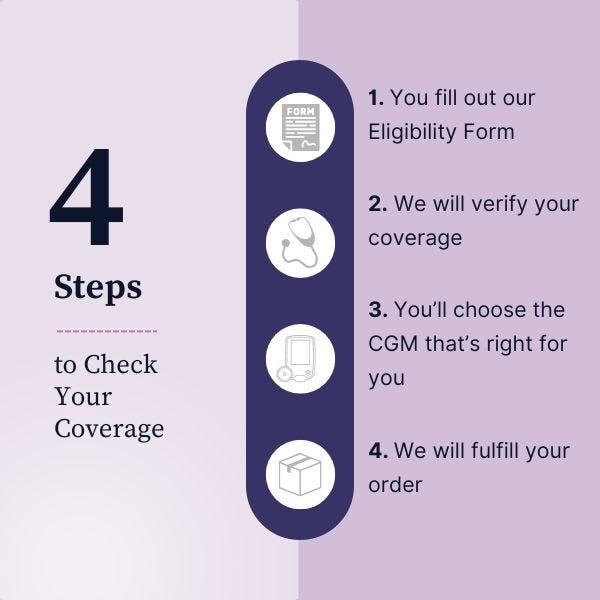

Ready to stay ahead of your blood sugar levels? Complete our secure Eligibility Form to see if your insurance covers a CGM. Our team will guide you through the process and help you find the best options.

Aeroflow Diabetes Disclaimer

Information provided on the Aeroflow Diabetes website is not intended as a substitute for medical advice or care from a healthcare professional. Aeroflow recommends consulting your healthcare provider if you are experiencing medical issues relating to diabetes care.