Key Takeaways:

- Continuous glucose monitors (CGMs) can be reimbursed through FSA and HSA accounts when prescribed by a healthcare provider, including the cost of the device, sensors, and transmitters.

- To qualify for FSA / HSA reimbursement, your healthcare provider's prescription is typically required for CGMs and related supplies, so it's essential to check your specific plan's guidelines.

- Using FSA or HSA funds for CGMs allows you to save on out-of-pocket costs while benefiting from tax-free contributions, helping you manage diabetes and monitor your blood sugar levels more effectively.

If you're paying a portion out-of-pocket for continuous glucose monitors (CGMs), using an FSA or HSA to cover the costs can be a beneficial way to save money while receiving tax benefits.

There are some key differences between FSAs and HSAs when it comes to utilizing them for CGMs. Read on to learn about both options to help you make the most of your tax-free funds while keeping your blood glucose levels in check.

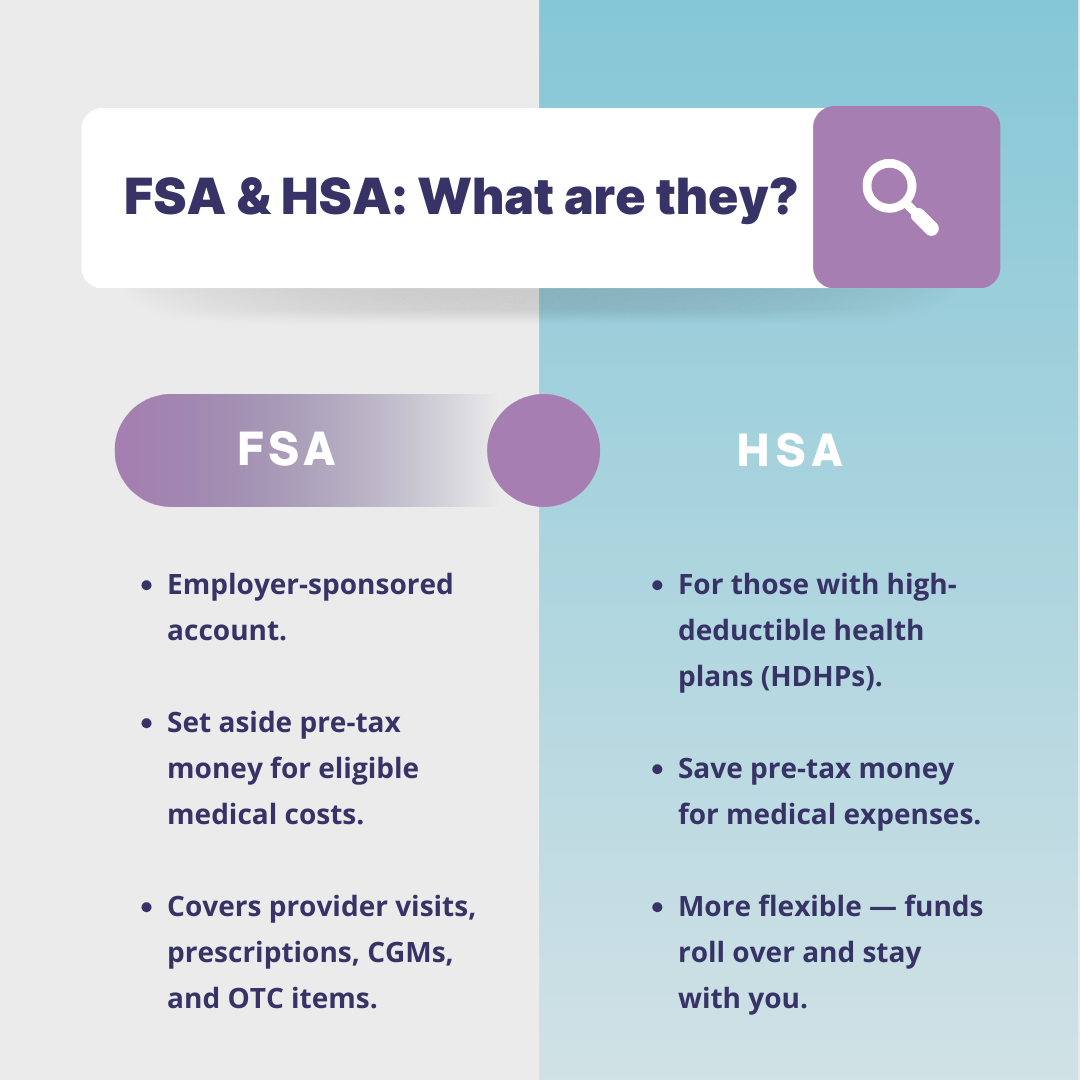

What Are FSA and HSA?

FSA (Flexible Spending Account) and HSA (Health Savings Account) are each types of tax-advantaged accounts that allow people to be reimbursed on out-of-pocket medical expenses. Both FSA and HSA vary in requirements, eligibility, and specific benefits.

An FSA is offered by employers, allowing employees to set aside money for eligible medical expenses, such as visits to your healthcare provider, prescription medications or CGMs, and over-the-counter items.

An HSA is available to those with high-deductible health plans (HDHPs). Similar to an FSA, it allows you to save money for medical expenses, but it comes with more flexibility.

FSA vs. HSA: What’s the Difference?

While both accounts help you save on taxes for medical expenses, they have important differences in how they work, who can get them, and what happens to the money at the end of the year.

-

Eligibility: An HSA is available only to people enrolled in a High-Deductible Health Plan (HDHP). In contrast, an FSA is an employer-sponsored benefit and can be offered with various types of health plans.

-

Fund Rollover: This is the biggest difference. An FSA is typically a "use-it-or-lose-it" account. You must spend the funds within your plan year, or you forfeit the money (though some plans offer a small rollover or grace period). An HSA, however, acts like a personal savings account. The funds never expire and roll over indefinitely, year after year.

-

Portability: An HSA is portable, meaning the account belongs to you, not your employer. If you change jobs, your HSA and all its funds go with you. An FSA is tied to your employer, so you generally lose access to the funds if you leave the company.

Understanding which account you have is key to planning your medical purchases, like your CGM and sensors, throughout the year.

Does FSA/HSA Cover CGMs?

As long as your CGM device is prescribed by a healthcare provider, it should be eligible for reimbursement through FSA and HSA.

Keep in mind that a doctor's prescription is typically required for CGMs to be eligible for FSA / HSA reimbursement, whether it be the cost of the CGM device itself, or additional supplies like sensors and transmitters, depending on certain guidelines.

It’s important to check with your personal FSA / HSA plan for any additional documentation or approval requirements, as there may be specific guidelines your plan follows.

Does Medicare Cover CGMs?

It’s estimated that CGM products can cost up to $6,000 a year out-of-pocket, but if you have Medicare or other private insurance plans, you may be eligible to receive CGM supplies at little to no cost. That cost, if any, could be paid for with FSA/HSA funds.

The products you can receive through Aeroflow Diabetes depend on what your specific insurance plan allows. Find out how insurance coverage works when it comes to what CGM works best for you and your personal insurance plan.

In summary, using your FSA or HSA for CGM devices and supplies is a smart way to offset out-of-pocket costs, as long as you have a prescription. The first step is to see how much your insurance will cover; from there, you can use your tax-free funds to handle the rest.

Do You Qualify for a CGM Through Insurance?

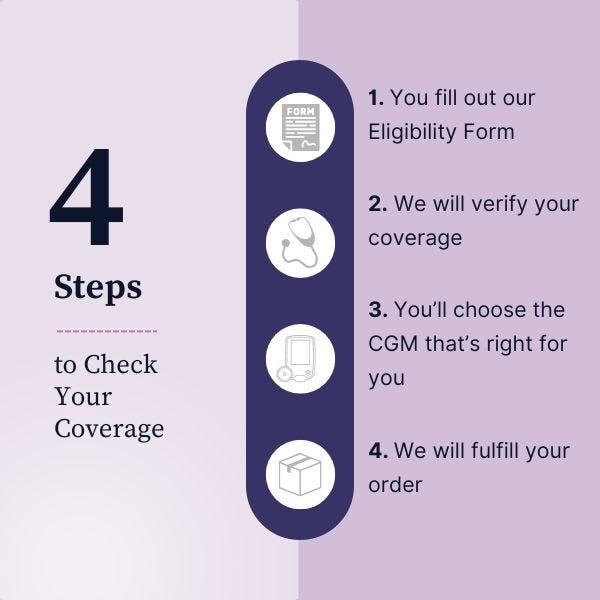

If you’re looking to get a CGM covered through Medicare or another insurance plan, you can order directly through Aeroflow Diabetes, with a prescription from your healthcare provider.

We’ll deliver your CGM device and/or supplies straight to your door and offer convenient monthly resupply services. We take care of the entire process! All you need to do is fill out our Eligibility Form to get started!

Once approved for coverage, you’ll just need to reach out to your healthcare provider for a prescription to receive your Dexcom or Abbott CGM.

Aeroflow Diabetes Disclaimer:

Information provided on the Aeroflow Diabetes website is not intended as a substitute for medical advice or care from a healthcare professional. Aeroflow recommends consulting your healthcare provider if you are experiencing medical issues relating to diabetes care.