Key Takeaways:

- Insurance can significantly reduce CGM costs, with many users paying as little as $0–$60/month compared to $300+ cash prices.

-

Aeroflow Diabetes simplifies the insurance process, handling eligibility checks, paperwork, and prescriptions on your behalf.

-

Even without coverage, CGMs can be worth the investment for better glucose control, fewer hospital visits, and long-term health savings.

Continuous glucose monitoring can transform daily diabetes care—helping you spot trends, manage highs and lows, and even avoid emergency situations. In this guide, you’ll explore whether insurance or paying cash makes the most sense for getting a CGM.

What Is a Continuous Glucose Monitor (CGM)?

Before diving into costs and coverage, it helps to understand what a CGM is and why it matters.

A CGM is a small wearable device that continuously tracks your glucose levels. Most CGMs consist of a tiny sensor placed just under the skin, a transmitter that sends data, and a receiver or smartphone app that displays your glucose readings.

Unlike fingerstick testing, CGM systems provide a continuous stream of glucose data, which allows you to catch highs, lows, and trends sooner. Popular options include Dexcom CGM (G6 and G7) and FreeStyle Libre (2 and 3), trusted by people with type 1 and type 2 diabetes.

Understanding Your Insurance Coverage

Knowing how insurance handles CGMs can help you weigh your options.

Insurance Coverage Criteria

To get a CGM covered by insurance, you usually need to meet certain qualifications. For many insurance plans and Medicare coverage, these include:

-

A diagnosis of type 1 diabetes or insulin-dependent type 2 diabetes.

-

If not insulin-dependent, documented hypoglycemic events.

Medicare requires that the CGM be used in conjunction with a receiver that displays glucose values and alerts. Sensors are not covered if the patient only has a smart device. Commercial insurance plans often follow similar guidelines, though coverage criteria and documentation can vary.

Co-pays

Even when a CGM is covered by insurance, there may be associated copays or out-of-pocket expenses depending on your insurance plan. Here's a quick look at potential costs:

-

Initial copays if your deductible has not been met.

-

Recurring copays ranging from $0 to $60/month (most commonly, patients either pay $0, or between $30-50/month).

NOTE: CGMs and sensors are FSA/HSA Eligible!

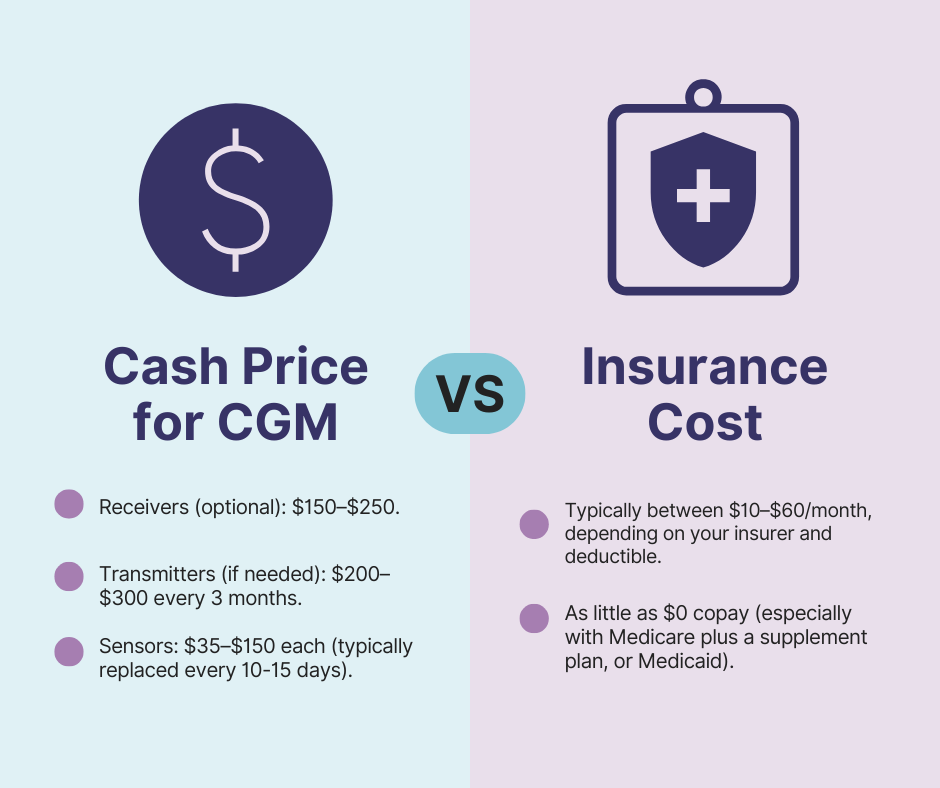

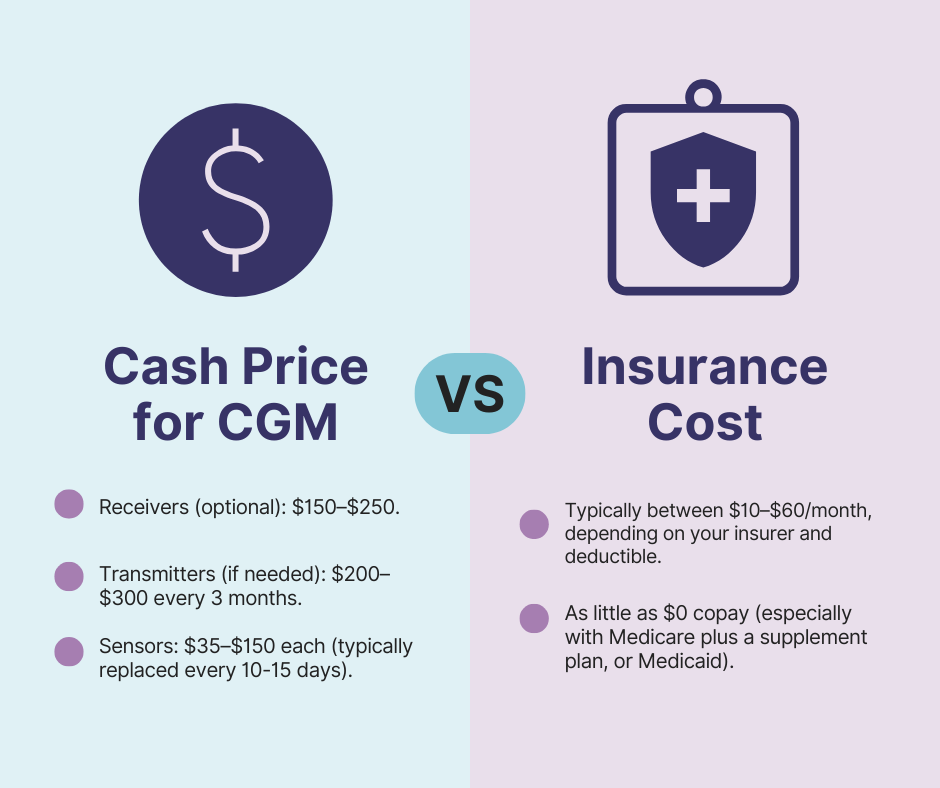

Breakdown of Cash Price vs. Insurance

Both cash and insurance have pros and cons. Below, we break down how to compare them.

Cash Price for CGM

If you’re considering paying out of pocket, here’s what to expect:

-

Sensors: $35–$150 each (typically replaced every 10-15 days).

-

Transmitters (if needed): $200–$300 every 3 months.

-

Receivers (optional): $150–$250.

Depending on the CGM model and frequency of use, the total cash price can range from $100–400 per month, or up to $5,000 per year.

Insurance Cost

When coverage applies, your expenses can be much lower:

-

As little as $0 copay (especially with Medicare plus a supplement plan, or Medicaid).

-

Typically between $10–$60/month, depending on your insurer and deductible.

Always verify your insurance plan’s coverage by requesting a benefits check or reviewing your summary of benefits. You can find out if you qualify for a CGM covered by your insurance by completing our eligibility form.

Comparing Total Costs

Here’s how different payment paths might compare:

| Cost Category | Dexcom G7 | FreeStyle Libre 3 Plus |

| Reader with insurance (one-time, deductible met) | ~$40-$70 | $0-$30 |

| Sensors, with Insurance (monthly, deductible met) | $0 - $60 | $0 - $30 |

| Sensors Cash Price (monthly, average) | ~$300 | ~$235 |

| Reader Cash Price (one-time) | ~$250 | ~$150 |

These values are based on averages across insured and non-insured patients, as well as product retail locations. Patient insurance plans and deductibles vary across payors, plans, and policies.

How to Navigate Insurance Coverage

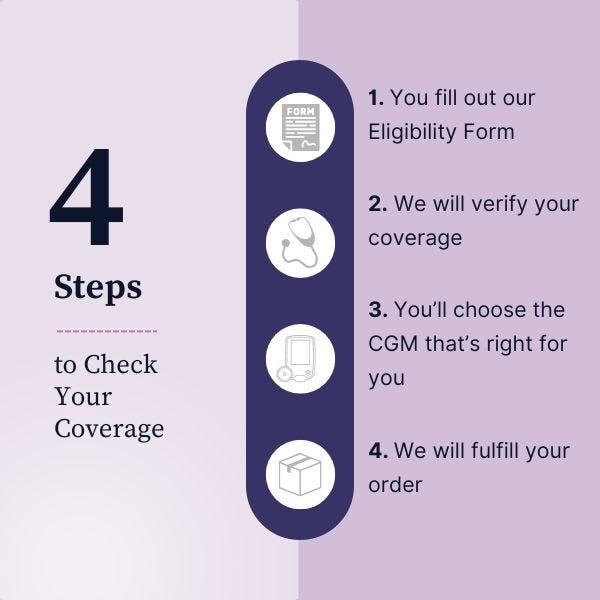

Starting with Aeroflow Diabetes

Getting a CGM covered by your insurance shouldn't be complicated, but navigating the coverage process can feel overwhelming. At Aeroflow Diabetes, we move through the process on your behalf, connecting the dots between your doctor, your CGM options, and your insurance provider. After you complete our brief eligibility form, our team works behind the scenes to verify your specific benefits, identify your available CGM options, and eliminate financial surprises by clarifying any out-of-pocket costs upfront. We also work to obtain the prescriptions and medical notes required for coverage and specialize in managing the prior authorization process, if needed.

Starting with Your Healthcare Team

Your doctor can play a key role in getting your CGM, and we streamline that process through our strong partnerships. We collaborate with over 1,200 endocrinology and general practice offices nationwide. If you are a patient at one of our primary partner offices, your doctor will send your prescription directly to us - which is when we get to work. We immediately handle all the insurance verifications and paperwork, so you don't have to. Once approved, we simply contact you to choose your CGM and arrange for direct-to-home delivery.

Is a CGM Worth It if You Pay Cash?

Even on a cash-only or high-copay path, many find CGMs worth the cost.

Constant glucose tracking helps you prevent low blood sugar, reduce stress, and improve long-term glycemic control. It can also cut hospital visits and healthcare costs over time.

If cash is the only route right now, talk to your healthcare team about switching insurance plans, enrolling in assistance programs, or using CGM data to fine-tune your care.

FAQs

Will Medicare cover a Dexcom CGM?

Yes, if you meet eligibility requirements surrounding diabetes diagnosis and insulin use.

What copay can I expect with insurance?

Anywhere from $0 to $60/month, depending on your plan.

What is the typical cash price for a Dexcom or Libre sensor?

Dexcom sensors: ~$120/month. Libre: ~$100/month.

Next Steps

Here’s what to do next:

-

Talk to your healthcare provider about whether continuous glucose monitoring is right for you.

-

Complete our eligibility form to find out if you qualify for insurance-covered products

-

Select the products that meet your needs

-

Sit back and relax while we handle the details. Your CGM and sensors will be delivered to your door in no time.

Still unsure which route is right for you?

Aeroflow Diabetes can help you verify insurance, understand your options, and get started with the right CGM for your needs. Complete our eligibility form to find out if you qualify today.

Disclaimer

Information provided on the Aeroflow Diabetes blog is not intended as a substitute to medical advice or care. Aeroflow Diabetes recommends consulting a doctor if you are experiencing medical issues or concerns.